The Facts About Mulch Hauling Services Huntsville Revealed

Table of Contents8 Simple Techniques For Mulch Hauling Services HuntsvilleAll About Excavating Services HuntsvilleFacts About Excavation Contractor Huntsville UncoveredNot known Details About Excavation Contractor Huntsville

Several of the main advantages consist of: Experienced team accustomed to regional laws Efficiency in excavating and completing projects Safety measures implemented to safeguard workers as well as the atmosphere Expense financial savings on tasks that are done appropriately the very first time If you're an Austin homeowner or company owner looking for excavation solutions, do not wait to get to out to the specialists at Venditti Demolition.Revenue will deal with services that can not file or pay their taxes on schedule due to a natural calamity. Find out more about catastrophe relief.

Washington's excise taxes use to all service tasks performed in the state. Companies, partnerships, sole proprietorships, joint ventures, nonprofit organizations, limited obligation organizations, and so on, conducting business in this state are all based on these taxes, also if they do not have a workplace here. Organizations based on any of Washington's import tax taxes must sign up with the Department of Income by completing a Company License Application.

Terms, building and construction tasks as well as a basic summary of the seven categories of building and construction will be covered. Washington's company and line of work (B&O) tax obligation is based on the gross invoices of service operations. This suggests there are no reductions for labor, materials, tax obligations or other costs of doing business. This is various from a revenue tax which is put on the net revenue from business procedures.

Unknown Facts About Dirt Works Huntsville

Organizations executing even more than one task might be subject to tax obligation under one or even more B&O tax classifications. Each company owes the B&O tax on its gross income.

Services making wholesale sales do not gather retail sales tax on their charges. Wholesale sales are those made to organizations getting a product or solution for resale.

However, depending on the kind of building being performed, the builder might also be taken into consideration the customer of materials included into the job. Describe the section addressing the certain building activity to locate the sorts of items that are made use of as a customer. Professionals might not utilize a reseller permit to buy things "made use of as a consumer" in performing construction solutions.

Use tax obligation is additionally due on things removed (such as rock) or produced (such as tooling) as well as made use of by the specialist in executing the building. The use tax obligation and also sales tax rates are click now the very same. The appropriate tax obligation price is identified by the place where the thing is first utilized or where the building solution is performed.

What Does Bobcat, Bulldozer, And Backhoe Huntsville Do?

Describing the tax obligation as "delayed" simply means that the settlement of sales tax is deferred till it is established that the products will not be marketed. Deferred sales tax is calculated on the purchase price. This consists of shipping/handling or products charges. The tax obligation rate and also place code (tax obligation territory) is based on where the contractor obtained the items, similar to sales tax obligation.

This consists of all consideration paid without deduction for expenses, even if those expenses would not be defined as building solutions if offered independent of a building contract. As an example, billings to a customer for structure authorizations, engineering fees, architectural costs, devices, as well as tax costs belong to the gross contract price based on tax obligation.

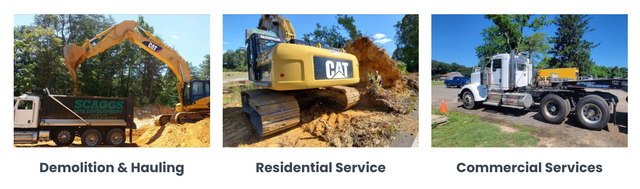

Demolition Services Huntsville Fundamentals Explained

When a contract asks for development repayments, tax schedules on the gross amount billed. Sales tax is considered accumulated when specified separately on agreement records and/or sales billings. An amount not paid as a result of a dispute undergoes tax till the unpaid claim is crossed out as an uncollectable bill.<

Some of the settlement amount may be thought about by the court to be rate of interest due to late repayments. This rate of interest is not part of the gross contract quantity, yet it undergoes tax obligation under the Solution as well as Other Activities B&O category. Losses endured by a professional due to a penalty provision for failure to finish job by a specified time are not deductible from the gross agreement rate in establishing tax obligations due.

Services may carry out building and webpage construction as a prime professional on one work, a subcontractor on one more, and as a speculative contractor on yet an additional job. Usually, a contractor is hired by the landowner and a is worked with by a prime service provider. For state tax purposes, the difference in between a prime specialist and also a subcontractor is only considerable on "customized" contracting work.